There are many businesses related to money, credit or investments. Let us understand how GIFT City is helping those businesses to grow through various subsidies and schemes.

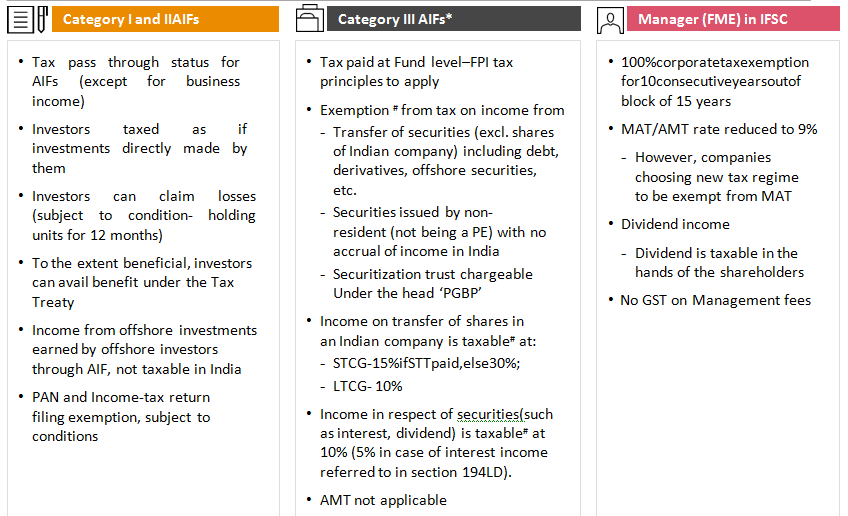

Fund Management Entities (FMEs) in IFSC

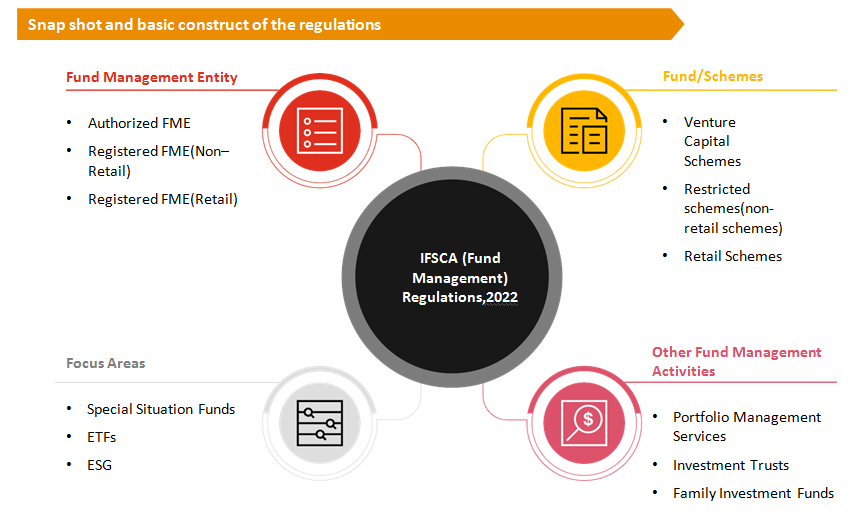

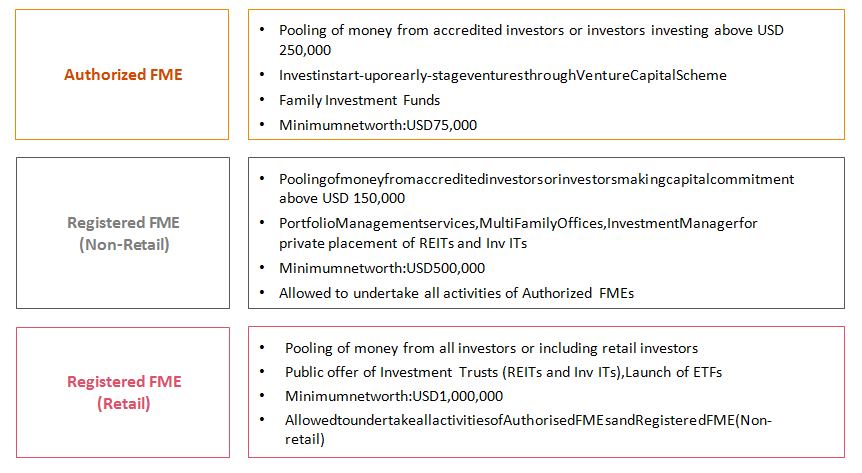

Based on the comprehensive report submitted in January 2022 by the Expert Committee on Investment Funds, draft regulations were issued by IFSCA for public comments. On April 2022, the IFSCA issued IFSCA (Fund Management) Regulations, 2022.

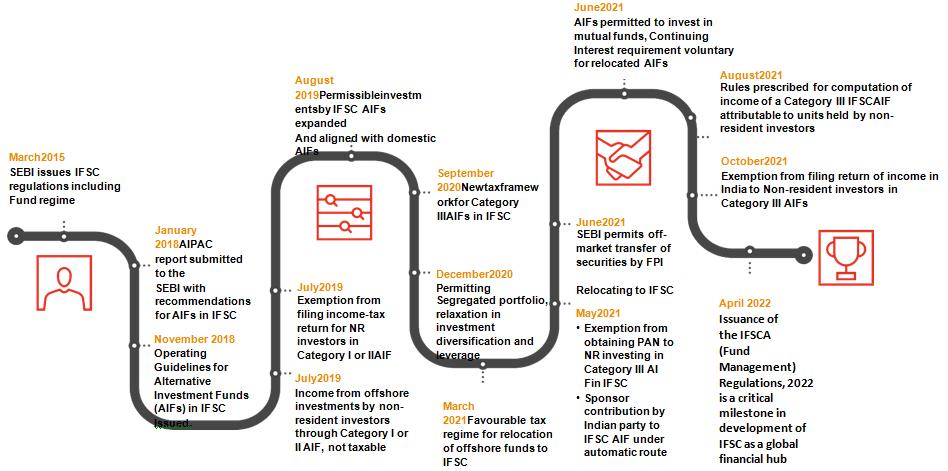

Journey of Fund regime in IFSC –

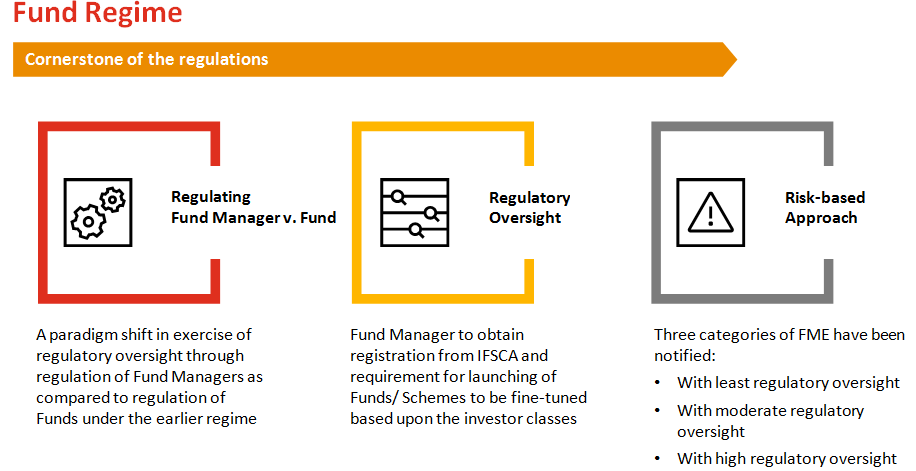

Cornerstone of the regulations

| Category of FME to launch a Special Situation Fund | Registered FME |

| Type of Fund | Close-ended fund |

| Legal structure of the Fund | Company or LLP or Trust |

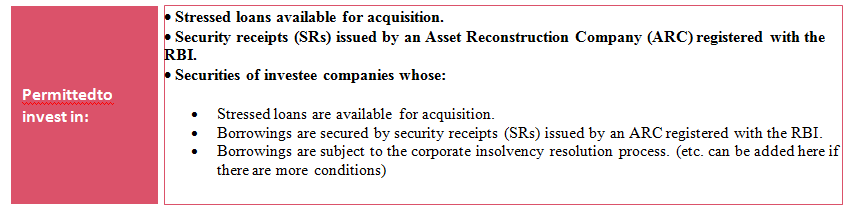

| Permissible Investments | Only in special situation assets |

| Leverage | Not permissible other than to meet day-to-day operational requirements |

| Scheme corpus, eligible investors, investment conditions | As may be specified by IFSCA from time to time |

| Computation of NAV, contribution by FME in the Fund/ scheme and other disclosure/ valuation norms | To apply as applicable to close-ended Restricted schemes |