What is IFSC in GIFT City?

- An IFSC caters to the customers outside the jurisdiction of domestic economy. Such centers deal with the flow of finance, financial products and services across the borders.

- IFSC as envisaged under the Indian context “is a jurisdiction that provides financial services to non-residents and residents (Institutions), in any currency other than Indian Rupee(INR)”

- IFSC is set-up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions

IFSC in India (GIFT CITY)

- In India, an IFSC is approved and regulated by the Government of India under the Special Economic Zones Act, 2005

- Government of India has approved GIFT City as a Multi Services Special Economic Zone (‘GIFT SEZ’) and has also notified this zone as India’s IFSC

- The launch of the IFSC at GIFT City is the first step towards bringing financial services transactions relatable to India, back to Indian shores

- IFSC unit is treated as a non-resident under extant Foreign Exchange Management regulations.

Features and objective of

establishment of GIFT IFSC

“My vision is that in ten years from now, GIFT city should become the price setter for at least a few of the largest traded instruments in the world, whether in commodities, currencies, equities, interest rates or any other financial instrument.” The concept of IFSC is simple but powerful. It aims to provide on-shore talent with an offshore technological and regulatory framework. This is to enable Indian firms to compete on an equal footing with offshore financial centres.“

Shri Narendra Modi, Hon’ble Prime Minister of India

“The first IFSC in India has been set up at GIFT City, Gandhinagar, Gujarat. An IFSC enables bringing back the financial services and transactions that are currently carried out in offshore financial centers by Indian corporate entities and overseas branches / subsidiaries of financial institutions (FIs)to India by offering business and regulatory environment that is comparable to other leading international financial centers in the world like London and Singapore. It would provide Indian corporates easier access to global financial markets. IFSC would also compliment and promote further development of financial markets in India.”

Ministry of Finance, Go

Potential for IFSCA (GIFT CITY)

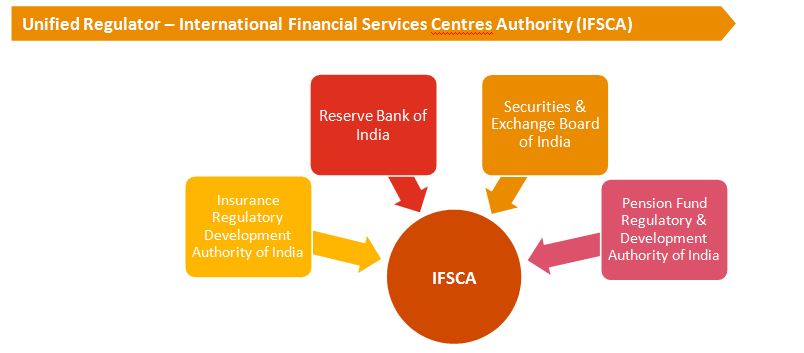

Regulatory powers of four financial services regulators in India vested in IFSCA with respect to regulation of financial institutions, financial services and financial products in the IFSC, making it a unified regulator for the IFSC.

Potential for IFSC (GIFT City) in India

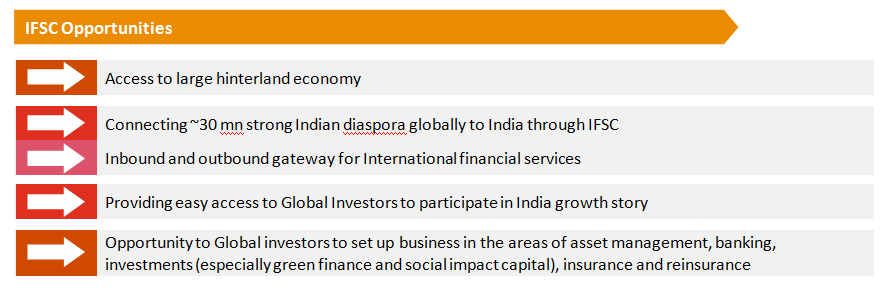

IFSC Opportunities (GIFT City opportunities)

IFSC Opportunities (GIFT City opportunities)

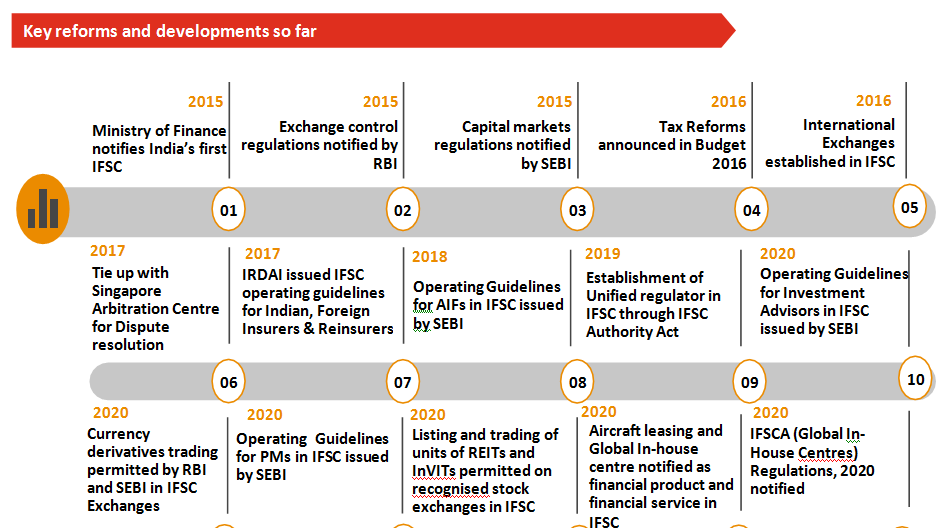

GIFT City IFSC Journey So Far